Guest Post: Buying a NRI Property? Here's what you should be careful about.

Welcome to our guest posts section. In this section, we selectively curate and publish articles from guest bloggers that we know will add value to our readers. Today’s guest post is about the points that you should keep in mind when buying a property from an NRI.

Large majority of Indians settled in overseas countries consider their stay of country as their ‘Karma-Bhoomi (land of action)’ and have dreams of returning one day to ‘Matru-Bhoomi (motherland)’. Every one of them have a dream of buying a house property in India with a view of having home of their own, for comfortable stay for the rest of their life.

In the past three decades, the liberalization, privatization and globalization policies of successive Governments have given wings to the dreams of millions of NRIs, OCIs (Overseas Citizens of India) and PIOs (Persons of Indian Origin) to acquire their dream home and also to reap the benefits of high returns on the investments made in immovable properties in India.

The investments made in properties in nineties (1990’s) and till say up to 2005, went well as NRIs, OCIs and PIOs could grab good properties at right price and they were seldom cheated by then suppliers (builders, developers, marketing agencies, brokers etc.). It all started by mid of 2005, when few unscrupulous suppliers, who could be termed as ‘fly by night’ operators found that it is much easier to dupe NRIs community. By reaching out to such countries where majority NRIs reside and conducted road shows with attractive ‘videos’ and ‘walk through presentations’ and sold properties which were either only on papers or properties without legal title or with disputes etc. This heinous activity continued unabated for long time, as it was happening with connivance of few corrupt officials of Government departments and Banks, which funded such bogus projects. The result; it is estimated that every fourth property held by NRIs is disputed property by way of improper title, unauthorised development / construction, violation of Govt. rules thereon or litigated, facing Court proceedings.

And the worst part is the fall of real estate sector in the past five years and as such real estate prices have fallen by 25-30% of the peak prices of 2014-15.

Present Scenario

The ongoing downfall of real estate from the five years has witnessed long delays in completion of under-construction projects and uncertainty looms large of completion of such projects. Hence the demand for ready-to- occupy properties is on constant rise since 2-3 years. Another factor, thousands of those who had booked the flats during ‘pre-launch’ offers have flooded the market to sell their properties before registering the sale deeds, which is permitted under assignment clause in the sale agreement. Such resale offers are more attractive as normally the sale price in such deals is about 10-15% less than the price offered by the Builders, who are still sitting on pile of unsold inventory.

In resale market, especially apartments, which are say 2 to 5 years old are in demand, as the seller might have done basic interiors and the sale price is more affordable. It is likely that the seller has under taken post purchase formalities, such as the apartment is assessed for taxes by civic authorities, up to date taxed are paid, Khata is made in the name of seller and likely that the apartment has been funded by a Bank or HFC (Housing Finance Company), which gives comfort level of due diligence done on the property by lending Bank/HFC.

In view of above said factors, there are thousands of properties of NRIs, OCIs and PIOs on sale, some are genuine properties having marketable title, are in good condition and are having all requisite approvals from Government authorities. There are considerable properties, which are not having legal title and have no proper approvals from authorities and some are even offered at lesser prices of acquisition costs. Hence in the resale market, NRI properties look highly attractive to buy.

In such conditions, the buyers need to be extra careful in selecting the right property. They need to do lot more homework and need to show restraint before inking any deal.

Apart from seeking title verification from seasoned Property Advocate, the buyer should get the due diligence done by a Chartered Engineer/Architect who is well versed with regulations of RERA (Real Estate Regulation Authority), wherever RERA is applicable. One more important aspect is to be seriously viewed, while buying property from an NRI/OCI/PIO is the taxation angle, mandated by the Income Tax Department.

Taxation Aspects

Many of us are aware of Sec 194-IA of Income Tax Act, which mandates the purchaser of property to make TDS of 1% of sale consideration, if sale consideration Rs. 50 lakh and above and remit the same to Income Tax account on behalf of the seller. Even the Sub Registrar verifies the TDS details, before allowing for registration of sale deed. This tax implication is only when the seller is a Resident Indian.

When the seller is NRI/OCI/PIO, the taxation angle is bit complicated and necessarily both seller and purchaser need to avail of professional service from a Chartered Accountant, who is well versed with Sec 195 of Income Tax Act.

In the first instance, to know the rate at which TDS to be deducted, it is important to segregate between Short Term Capital Gains (STCG) and Long Term Capital Gains (LTCG). Any built property (capital asset) is held by the assesse is less than 2 years of acquisition, it is termed as STCG and if the property is held for more than 2 years, it is termed as LTCG.

The rate of Capital Gains tax is 30% in case of Short Term Capital Gains and 20% for Long Term Capital Gains.

There are two options under Sec 195 of income Tax for effecting TDS, as follows:

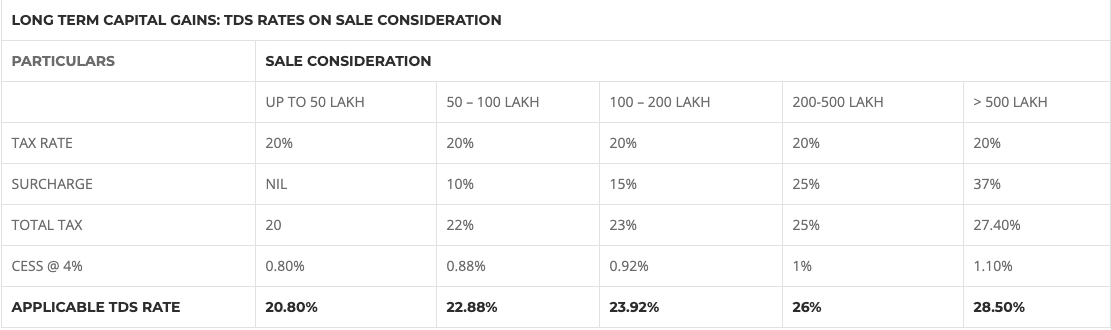

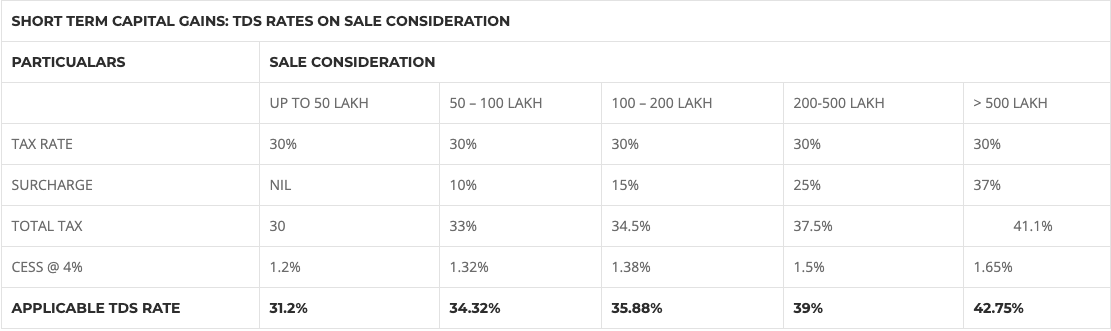

In the first option, the TDS rates works out as table 1 and 2 below for the properties sold and purchased during the current year (Financial Year: 2019-20 and Assessment Year: 2020-21).

Table 1

Table 2

From the above, in case of Long Term Capital Gains, one can notice that up to 28.5% of sale consideration (not Capital gains) is to be deducted as TDS and in case of Short Term Capital Gains, it goes up to 42.75%!

To save on this huge TDS, there is an alternative method, wherein the seller can obtain lower tax deduction certificate from Assessment Officer of Income Tax Dept. It is a lengthy process and there are riders to be eligible for seeking such a certificate. The seller needs to produce last four years Income Tax Returns in India, executed sale agreement showing the details of purchaser, sale consideration and other conditions etc. The application should contain Capital Gains/Loss computation certified by CA and few more documents. It may take couple of months to get the certificate from Assessment Officer of Income Tax Dept. and accordingly, the purchaser has to deduct TDS as per certificate and remit the same to Income Tax Dept.

Most of the time, the second option is not availed as it is difficult to meet the requirements and NRIs have no time to apply, follow up and get the lower tax certificate.

Hence, whether unknowingly or to avoid higher TDS implications, many NRIs don’t declare that they are NRIs and plan to sell their properties. Here the onus is on the purchaser to verify the status of seller and act accordingly; failing which the purchaser will land in taxation mess! After selling, since the NRI may be off the scene, the tax authorities will hound the purchaser to collect due taxes.

Sometimes, the NRIs will execute GPA in favour of their close relative, who is Resident Indian and even seek sale proceeds to be made to the Attorney’s (GPA Holder’s) account. This is offence. As per Sec 195, it is mandatory that the sale proceeds have to be deposited in the NRI’s authorized bank account maintained in India. The Attorney can act on conveying the title on behalf of Principal/Executor, but cannot receive sale proceeds in his account.

The procedure to deduct TDS is slightly lengthy also. To start with the purchaser has to have TAN (Tax Assessment No.) before making the TDS against the PAN of seller. After deducting TDS and remitting the TDS amount, the purchaser has to file Tax Return in the next Quarter beginning, when it falls due. After that, he needs to issue Form No 16 of Income Tax to the seller. Only then, seller will get the credit of advance tax payment in his account. Then, after the financial year is over, the seller has to file his ITR with computation of all incomes, including Capital Gains Computation certified by CA. In large majority of cases, NRIs will get refund, as TDS done is higher than the applicable capital gains tax.

Tail Piece

It is advisable to exercise restraint and do your homework by seeking assistance from seasoned professionals like property advocate, chartered engineer/architect and Chartered Accountant before you embark on purchasing property from NRI/OCI/PIO.

The author is Managing Director of PropSeva (www.propseva.com). This article was originally published at https://www.propseva.com/income-tax-on-property-sold-by-nri/ and has been reproduced with permission.